Contra accounts definition

Both operating expenses and cost of goods sold (COGS) are expenditures that companies incur with running their business; however, the expenses are segregated on the income statement. Unlike COGS, operating expenses (OPEX) are expenditures that are not directly tied to the production of goods or services. Because COGS is a cost of doing business, it is recorded as a business expense on income statements. Knowing the cost of goods sold helps analysts, investors, and managers estimate a company’s bottom line. While this movement is beneficial for income tax purposes, the business will have less profit for its shareholders. Businesses thus try to keep their COGS low so that net profits will be higher.

Ask a Financial Professional Any Question

The COGS is identified with the last purchased inventories and moves upwards to the beginning inventories until the required number of items sold is fulfilled. For the 120 remaining items in inventory, the value of 20 items is $15/item, and the value of 100 items is $20/item. The FIFO method presupposes that the first goods purchased are also the first goods sold. This assumption is closely matched to the actual flow of goods in most companies.

Allowance Method

This reduces the risk of errors in COGS calculations and improves overall inventory management efficiency. Generally Accepted Accounting Principles or International Accounting Standards, nor are any accepted for most income or other tax reporting purposes. The value of goods held for sale by a business may decline due to a number of factors. The goods may prove to be defective or below normal quality standards (subnormal). The market value of the goods may simply decline due to economic factors.

What is a contra revenue account?

Administration and Sales Department Costs shouldalso be transferred to COGS (Class 7A). To do this, a standard absorption baseis ideal, and any effort expended to design one is worthwhile. But even a simplebase is sufficient in Internal Accounting to provide a reliable and practicalreport.

The earliest goods to be purchased or manufactured are sold first. Since prices tend to go up over time, a company that uses the FIFO method will sell its least expensive products first, which translates to a lower COGS than the COGS recorded under LIFO. It will be written down instead of written off if the inventory still has some fair market value but its fair market value is found to be less than its book value.

- Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

- Accounts within the Cost Of Goods Sold (COGS) Account class are used ascontra-accounts.

- In other words, contra revenue is a deduction from gross revenue, which results in net revenue.

- Contra asset accounts include allowance for doubtful accounts and accumulated depreciation.

- Choosing the appropriate cost flow assumption impacts COGS calculation and inventory valuation.

An inventory write-off is an accounting term for the formal recognition of a portion of a company's inventory that no longer has value. It can be expensed directly to the cost of goods sold (COGS) account or it can offset the inventory asset account in a contra asset account. This is commonly referred to as the allowance for obsolete inventory or inventory reserve. Contra accounts are used to reduce the original account directly, keeping financial accounting records clean. The difference between an asset's balance and the contra account asset balance is the book value.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. By understanding COGS, you can explore strategies, such as reducing costs, streamlining processes, and reducing waste, to improve your bottom line. COGS is a key performance indicator (KPI) that tells you how much it costs to produce your product. Selling, general, and administrative (SG&A) expenses are usually put under this category as a separate line item. This can also be calculated simply by multiplying the number of pieces sold per jewel by its cost per unit and getting the total of all values (see column on the Amount of Inventory Sold Using Specific Identification Method).

Investors looking through a company’s financial statements can spot unscrupulous inventory accounting by checking for inventory buildup, such as inventory rising faster than revenue or total assets reported. For example, airlines and hotels are primarily providers of services such as transport and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods. Both of these industries can list COGS on their income statements and claim them for tax purposes. The balance sheet has an account called the current assets account.

Since it is a contra asset account, this allowance account must have a credit balance (which is contrary to the debit balances found in asset accounts). The Allowance for Doubtful Accounts is directly related to the asset account entitled Accounts Receivable. Therefore, the net amount of the accounts receivable that is expected to turn to cash is $38,000. Contra equity is a general ledger account with a debit balance that reduces the normal credit balance of a standard equity account to present the net value of equity in a company’s financial statements. Examples of equity contra accounts are Owner Draws and Repurchased Treasury Stock Shares.

Now we have to deal with inventory/goods that customers just returned. Find ways to reduce or eliminate waste in your production process. For example, if you are a manufacturing company, you may want to invest in machinery that can automate some of the production processes. You will need to strategically find ways to reduce your costs so that you can improve your profitability. The cost of goods available for sale or inventory at the end of the second quarter will be 220 remaining candles still in inventory multiplied by $8.65, which results in $1,903. The IRS has set specific rules for which type of method a company can use and when to make changes to the inventory cost method.

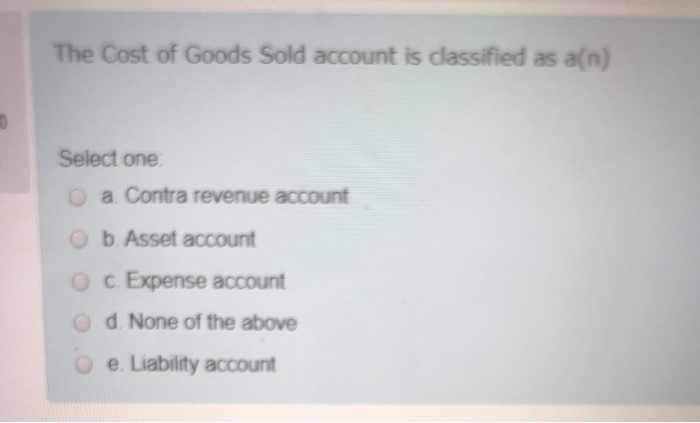

There are four methods that a company can use when recording its inventory sold during a period. The ideal selling price should be at least greater than $7 to make a profit since it needs to account for both COGS and the additional is cost of goods sold a contra account indirect costs like marketing and shipping. COGS only applies to those costs directly related to producing goods intended for sale. In other words, contra revenue is a deduction from gross revenue, which results in net revenue.